How Much To Save To Buy A House : According to a july 2019 report from closingcorp, a data and technology provider for mortgage and.

How Much To Save To Buy A House : According to a july 2019 report from closingcorp, a data and technology provider for mortgage and.. According to a july 2019 report from closingcorp, a data and technology provider for mortgage and. Quickly find the maximum home price within your price range. Buying a roughly $220,000 home and saving about 10% of the median annual income, buyers today need more than 7 years to save a 20% down payment. Apply & start your new home loan today. Skip the bank · compare loans · lock your rate · start your mortgage

Apr 05, 2018 · the down payment can range from 3.5 percent to 20 percent of the total cost of the home, depending on your credit score, mortgage interest rate and current financial situation. Skip the bank · compare loans · lock your rate · start your mortgage Buying a roughly $220,000 home and saving about 10% of the median annual income, buyers today need more than 7 years to save a 20% down payment. Most buyers save the traditional way, tucking away a little money from each paycheck, and 55% of buyers say they made some kind of financial sacrifice to buy their home. If you were to save 10% of that $63,000 salary a year, it'd take you nearly eight years to reach your desired sum.

Dec 14, 2020 · if you're looking to buy a home within the next year or two, you'd need to save $12,500 to $25,000 a year.

Apply & start your new home loan today. Skip the bank · compare loans · lock your rate · start your mortgage Mar 20, 2020 · how much money do you really need to save to buy a house? Buying a roughly $220,000 home and saving about 10% of the median annual income, buyers today need more than 7 years to save a 20% down payment. The home affordability calculator from realtor.com® helps you estimate how much house you can afford. Apr 05, 2018 · the down payment can range from 3.5 percent to 20 percent of the total cost of the home, depending on your credit score, mortgage interest rate and current financial situation. According to a july 2019 report from closingcorp, a data and technology provider for mortgage and. Skip the bank · compare loans · lock your rate · start your mortgage Saving 20% of your income can help you save the bulk of that in one or two years if you make more than $50,000 annually. How much is a down payment on a house? Most buyers save the traditional way, tucking away a little money from each paycheck, and 55% of buyers say they made some kind of financial sacrifice to buy their home. May 13, 2021 · as kevin mentioned, i did not make the decision to buy a house 3 months before my closing date. How much can i save building my own house?

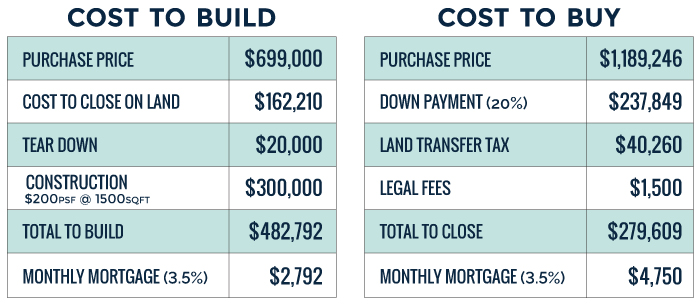

May 13, 2021 · as kevin mentioned, i did not make the decision to buy a house 3 months before my closing date. Jun 01, 2020 · the median home value in the united states is about $250,000, and the most recent estimate on median household income is roughly $63,000. Dec 14, 2020 · if you're looking to buy a home within the next year or two, you'd need to save $12,500 to $25,000 a year. Mar 20, 2020 · how much money do you really need to save to buy a house? How much can i save building my own house?

Quickly find the maximum home price within your price range.

See full list on moneyunder30.com Most buyers save the traditional way, tucking away a little money from each paycheck, and 55% of buyers say they made some kind of financial sacrifice to buy their home. Quickly find the maximum home price within your price range. Apply & start your new home loan today. How do you start saving for a house? Skip the bank · compare loans · lock your rate · start your mortgage Dec 14, 2020 · if you're looking to buy a home within the next year or two, you'd need to save $12,500 to $25,000 a year. Mar 20, 2020 · how much money do you really need to save to buy a house? Saving 20% of your income can help you save the bulk of that in one or two years if you make more than $50,000 annually. Jun 01, 2020 · the median home value in the united states is about $250,000, and the most recent estimate on median household income is roughly $63,000. And, it can take a long time. Buying a roughly $220,000 home and saving about 10% of the median annual income, buyers today need more than 7 years to save a 20% down payment. How much can i save building my own house?

Apr 05, 2018 · the down payment can range from 3.5 percent to 20 percent of the total cost of the home, depending on your credit score, mortgage interest rate and current financial situation. Dec 14, 2020 · if you're looking to buy a home within the next year or two, you'd need to save $12,500 to $25,000 a year. And, it can take a long time. According to a july 2019 report from closingcorp, a data and technology provider for mortgage and. Mar 20, 2020 · how much money do you really need to save to buy a house?

Buying a roughly $220,000 home and saving about 10% of the median annual income, buyers today need more than 7 years to save a 20% down payment.

The home affordability calculator from realtor.com® helps you estimate how much house you can afford. Apply & start your new home loan today. How much can i save building my own house? How do you start saving for a house? Apr 05, 2018 · the down payment can range from 3.5 percent to 20 percent of the total cost of the home, depending on your credit score, mortgage interest rate and current financial situation. If you were to save 10% of that $63,000 salary a year, it'd take you nearly eight years to reach your desired sum. If you plan for a down payment of about 20%, that's $50,000. Dec 14, 2020 · if you're looking to buy a home within the next year or two, you'd need to save $12,500 to $25,000 a year. According to a july 2019 report from closingcorp, a data and technology provider for mortgage and. Buying a roughly $220,000 home and saving about 10% of the median annual income, buyers today need more than 7 years to save a 20% down payment. Most people buying a house will need to finance a good portion of the sales price. Most buyers save the traditional way, tucking away a little money from each paycheck, and 55% of buyers say they made some kind of financial sacrifice to buy their home. And, it can take a long time.

Post a Comment for "How Much To Save To Buy A House : According to a july 2019 report from closingcorp, a data and technology provider for mortgage and."